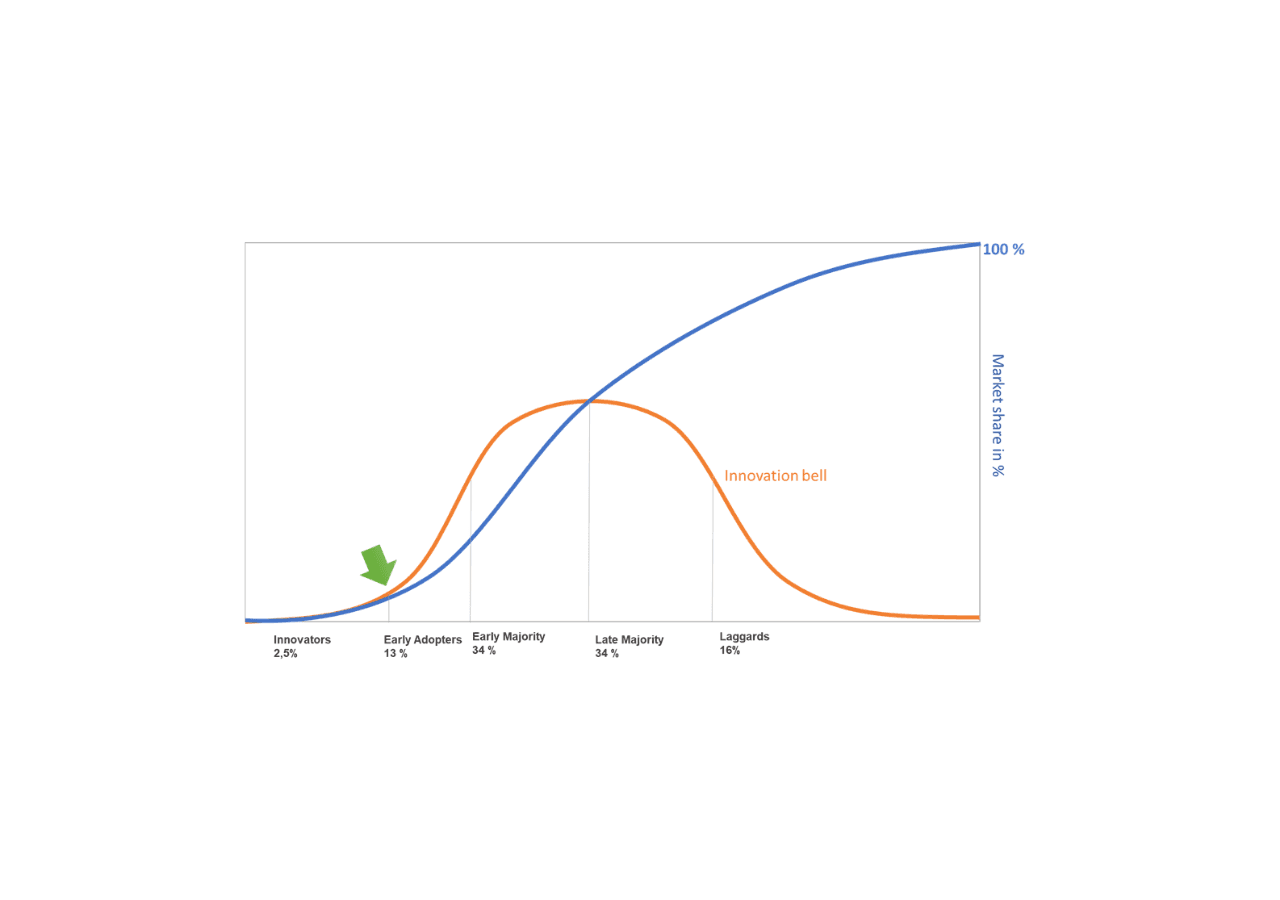

According to eVTOL.com and Forbes, strong revenues are foreseen early in 2026 and expected to amount to $2 billion per company for Joby Aviation, Archer and Lilium. For context, a company like Leonardo Helicopters represents an equity value of $4.4 billion. These figures can explain how the NASDAQ is speculating on these new actors.

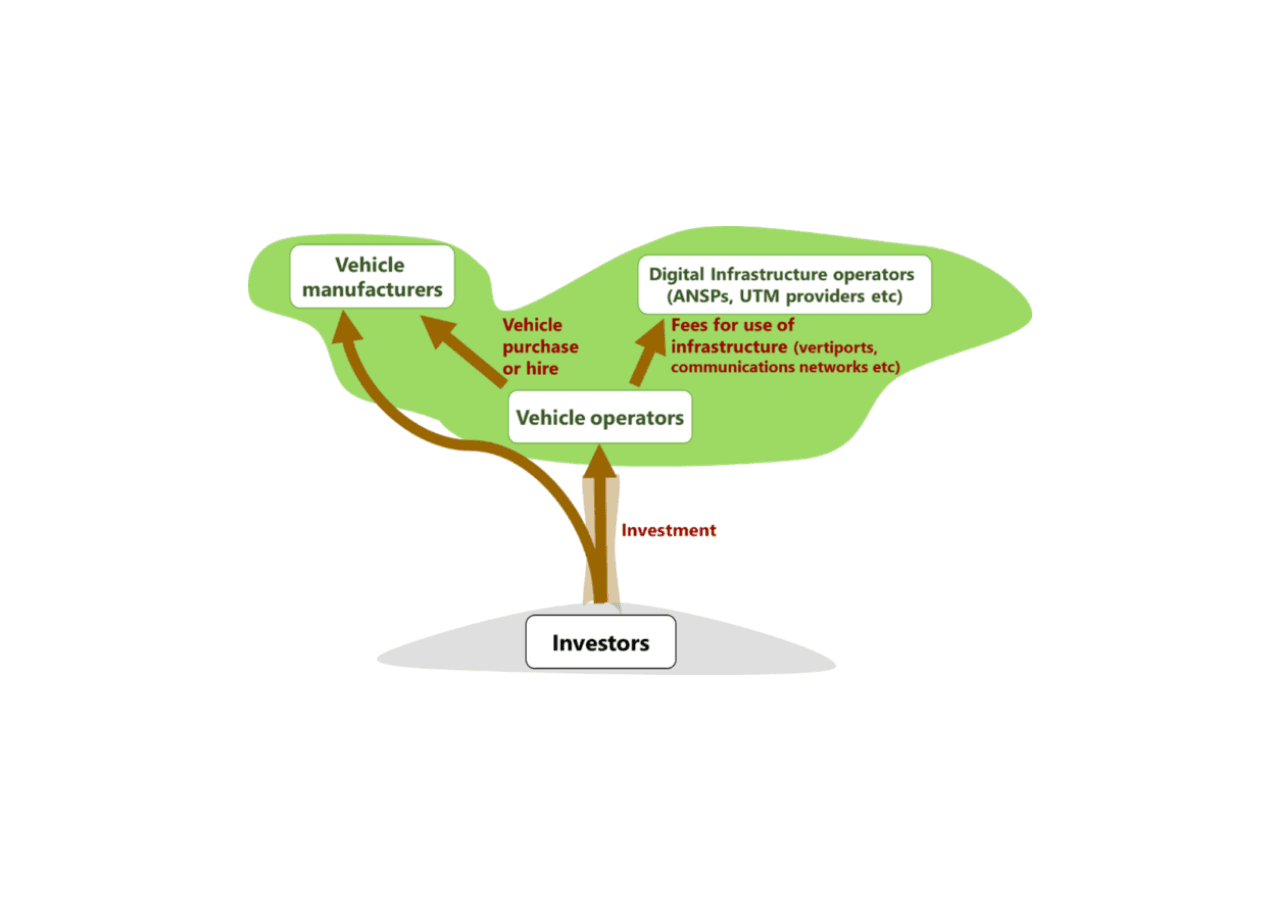

Vehicle operators.

From vehicle manufacturers the operational revenue streams branch out into passenger-carrying services and package delivery services; each with different business cases. Package delivery can help with solving ground-based vehicle routing problems or for speeding up delivery between industrial facilities and logistic centres [Seat/Sesé example]. Additionally, drone based delivery can support hospitals as Skyports has done for the NHS in Scotland, or provide cost-efficient solutions when road infrastructure is lacking, as demonstrated by Zipline operations in Rwanda. The logistics industry also sees drones as providing other ways to be environmentally friendly.

For passengers, Mobility as a Service (MaaS) is one expected operating model, where passengers call for a ride through an app when they need one, as in Uber or Lyft. For both passenger- and package-carrying services, expansion will be fostered by cloud computing, artificial intelligence and hyper-automation to keep the service affordable and customer-oriented.

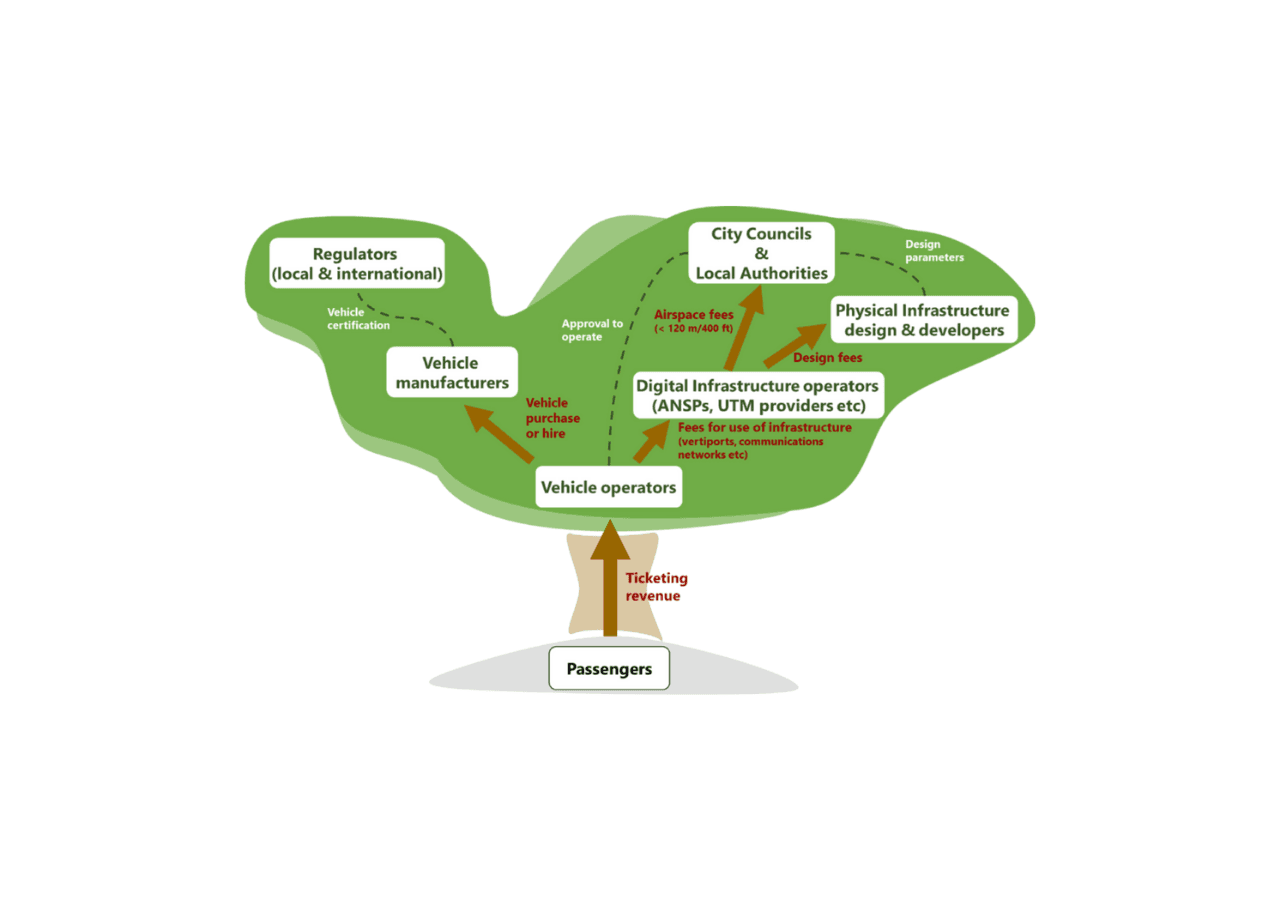

Infrastructure providers.

These concepts of operations will need both physical and digital infrastructure, giving rise to another revenue flow. A physical network of take-off and landing points, known as vertiports, could be located on the roofs of railway stations, car parks or existing buildings, or alongside waterways on floating platforms. This is likely to be of interest to public and private real estate owners, especially since, according to Volocopter, a Voloport could be housed within a 500 m2 surface area, including energy/charging provision, storage and maintenance. Hosting a vertiport could offer new and lucrative ways to value otherwise overlooked assets. Firstly, as a steady form of rental revenue and secondly through secondary revenue via passenger traffic (eg advertising, retail, commercial services such as Click&Collect, or even co-working). This network is not yet in place, but investment partnerships are underway, such as that between Hyundai and Urban-Air-Port Ltd, with its first infrastructure focal point being the UK city of Coventry.

The physical infrastructure landscape would not be complete without mentioning the role of airports. Airports have several revenue opportunities in UAM, one that is much talked about is the attraction of continuing the customer journey through to the final destination, typically the city centre, using UAM. But more than that, regional airports and smaller airfields could provide eVTOL storage, maintenance and charging (power) services. Florida Airport, Munich Airport and Aéroport de Paris are all partnering with UAM Companies to test those operational models and study associated business models.

Digital infrastructure spans data networks and services supporting communication, navigation and surveillance systems, and extends to include integrated mobility systems that mirror reality. A new digital infrastructure is a key enabler for UAM, and another area of investment focus. The market is forging ahead with its own infrastructure solutions, for example Volocopter has partnered with Lufthansa Industry Solutions and Microsoft to develop a proprietary intelligent and integrated urban air mobility software platform it is calling VoloIQ. In our own White Paper, we illustrated the power and necessity of an effective mobility observatory to facilitate the integration of UAM into existing transport modes, providing total mobility visibility in the urban environment.

From the aviation perspective, air navigation service providers (ANSPs) already control airspace on behalf of a State, and will want to control (and presumably take revenue for) UAM traffic – partly on the basis that they see a need for integration with existing air traffic. This is why manufacturers of air traffic management systems have shown interest in the potential threat coming from emerging UTM Service Providers like Unifly, Airmap or Altitude Angel, who are developing UTM systems to control and organise unmanned traffic and maybe more. Some ANSPs have progressed the idea of providing UTM services by themselves in order to generate additional revenue, but funding new services with uncertain business models is a likely blocker. Indeed, after developing valuable UTM capabilities in house or through Public Private Partnerships, the main concern is the momentum of the drone market and impact of local state regulations covering drone operations inside national airspace. Through its U-space initiative, the European Commission intends to strengthen the drone management ecosystem while preserving the safety of airspace users and fostering future transport and logistic services. Those EU regulations will be applicable in 2023 and will guide European stakeholders (ANSPs, USSPs, Drone operators, Member States) on what to do with drones in the future.

Interestingly, communications providers (eg Orange, Vodafone) have a strategic advantage as the only ones currently able to locate and communicate with UAM vehicles. They will likely develop revenue in 5G service and cloud computing, but it is unclear whether they could make a profitable commercial venture as Drone service providers. Most civil aviation authorities will require certification for operating as UTM service providers, making this part of the market appear more difficult to reach.

When it comes to the operators of the digital infrastructure, the trend is towards several or many, rather than one or few. Recently, the European Aviation Safety Agency (EASA) adopted a U-Space regulation that will foster competition between digital infrastructure operators. Similarly, in the United States, the UAS Traffic Management (UTM) ecosystem is known as drone operator centric, where drone operators can be supported by multiple UTM Service Providers (USP). And China, home to the biggest professional drone manufacturer (DJI) and pioneer air taxi company (EHang), has implemented regional UTM Services based on cloud services supervised by local and national authorities.

Regulatory landscape.

The influence of regulatory authorities is critical for business. A stable and clear regulatory framework will enable market participants to develop their vision and secure long-term investment. Air Taxis will carry stringent certification requirements, with estimated investment needed of at least $1 billion to complete the process. At these levels, market participation could be reduced or even wiped out. The FAA and EASA have understood these concerns, but designing and adopting safety regulations take time and effort. Some key hurdles are poised to be surmounted, with the development of the U-Space Program and the publication of UAS regulations in Europe. The US regulator is adopting a pragmatic approach to gap filling by providing waivers to serious drone operators. Meanwhile, NASA and the FAA have developed UTM architecture and UAS regulation too. However, for UAM developers there are still major regulations awaited in order to unlock the market, such as electric propulsion certification, eVTOL airworthiness and vertiport provision.

It is important to note that already regulations have been developed much faster than usual on the back of market demand for drone operations. Outside the Covid-19 context, EASA has built a regulatory environment within five years, and likewise the US. The involvement of industry through R&D bodies like the SESAR JU and JARUS contributed significantly to the EU regulatory effort. There is still a lot to do, but the will is there.

So, in 2035 how might these key UAM stakeholders be connected? The following graphic shows how the stakeholder groups and revenue flows are likely to grow in the coming years, as UAM begins to become established.

UAM early majority ecosystem ~ 2035.