COVID-19 has had a major impact on the European aviation sector. It’s difficult to see an industry I love struggle, but in this blog, I’m going to try and convince you (and myself) that not all is as it seems. I am going to throw a light on some of the financial incentives in place to help the sector recover, while tackling some of the environmental negatives associated with the industry pre-COVID.

Pit stops and positives for greener aviation

An additional ‘pit stop’.

Never has our industry seen this level of downturn. Yes, this has affected the industry massively, but much like a safety car incident during an F1 race, the slow-down has given some players the opportunity to take an additional ‘pit-stop’ and amend their strategy for the future.

Pre-COVID, aviation in Europe had reached its capacity limit from an airspace and air traffic management perspective. We were seeing a push towards virtualised and data-centric solutions to help optimise airspace management. These advancements were exciting to see in an industry that is historically slow to adopt new technologies.

Alongside the capacity crunch was an even bigger pressure on aviation to reduce its impact on the climate. There is no denying that the industry needed to do better and many of our customers accepted this – building sustainable initiatives into their long-term strategies. However, as is the case in business, commercial targets have always taken priority when demand for passenger travel was arguably at an all-time high, meaning that sustainable initiatives often took a ‘back seat’. This ‘pit-stop’ could provide an opportunity to shift the mindset of the aviation sector towards achieving a more sustainable future.

Sustainable funding for the future.

Indeed, we are seeing clients and state organisations take advantage of this ‘pit stop’ and increase their efforts to develop virtualised and data-centric solutions. For example, our support to the European Commission assessing the feasibility of a future ATM data services market has continued despite the current traffic downfall, indicating the importance of digitalisation and restructured service delivery models to future plans. These will help with resilience and efficiency, but what about solutions around future sustainability?

My colleague Benjamin Bouzon talks about why targeting sustainability will pay off in the future in his blog on the topic. Most notably, he referenced a study from 2018 (which we are currently helping update) on the Challenges of Growth in aviation from EUROCONTROL. It found that of the >90 organisations surveyed, almost half had not begun to plan for adapting to climate change impacts – with many citing ‘no financial resources’ as the reason for their inaction. So where is the money?

The additional financial pressures of today’s crisis just adds to the difficulty for organisations wanting to fund sustainability projects using internal resource. Economic and financial relief measures have been put in place in Europe (and globally) to support aviation stakeholders. However, we are starting to see funding mechanisms have a ‘green’ agenda, with sources asking organisations to demonstrate sustainable credentials to access their capital.

Incentivising sustainability.

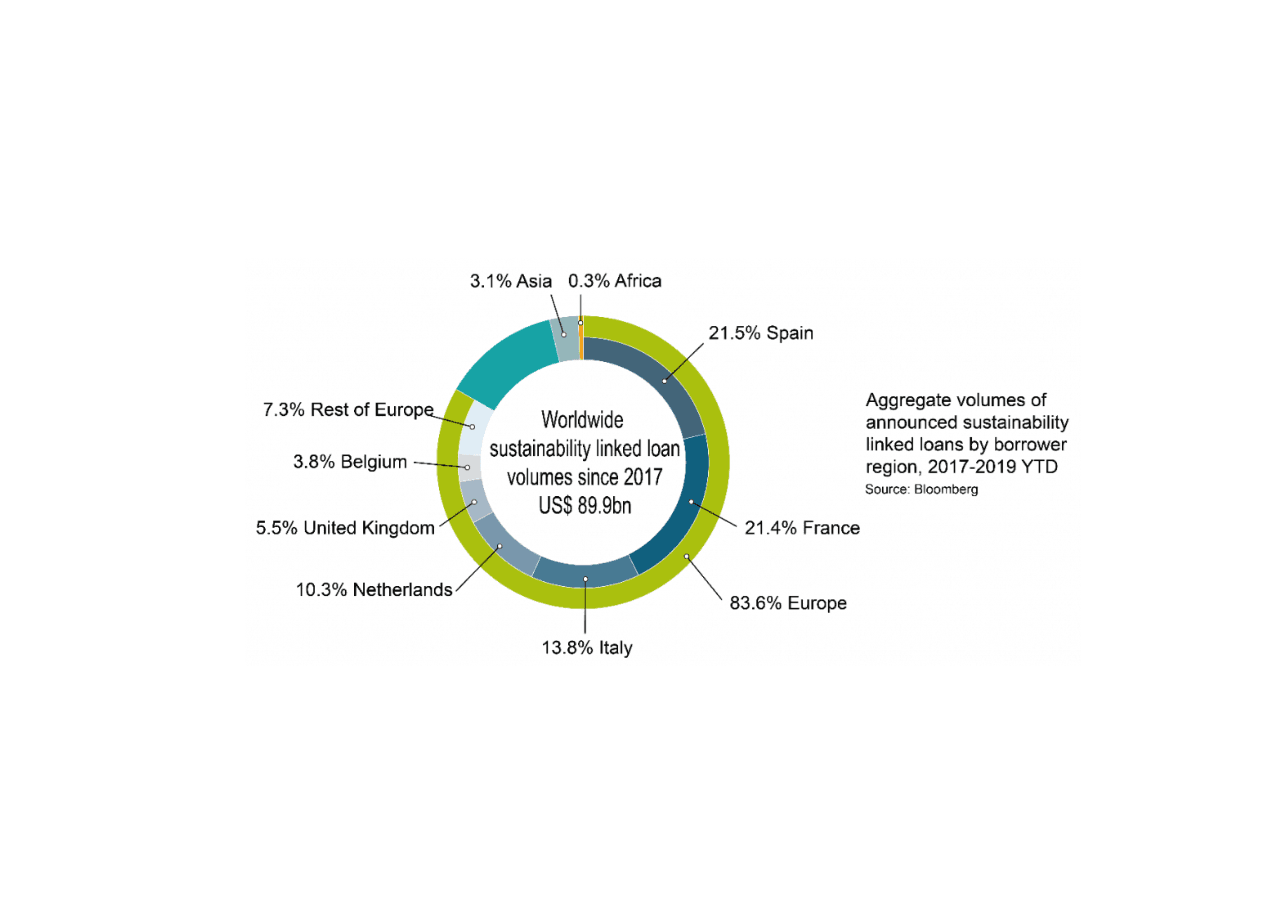

Banks have been offering ‘green loans’ or ‘sustainability linked-loans (SLLs)’, both of which have been highly popular over previous years. The global use of SLL’s grew rapidly in 2019, especially in Europe, where almost 80% of all SLLs were issued. Earlier this year, JetBlue used its strong environmental, social and corporate governance (ESG) track record to become the first airline to secure a sustainability-linked loan. According to Bloomberg, companies raised $62 billion of SLLs worldwide in the first nine months of 2019, beating 2018’s full-year total.

The two-way pricing structure of an SLL means that the borrower must meet specific targets to be offered a reduced price for the loan. This structure could attract criticism as ultimately the lender will benefit from the borrower’s failure to meet its ‘green’ targets.

While ‘green’ borrowing is still a viable option for many to access funds today, the popularity of such mechanisms has prompted governmental funding institutions to follow suit and release funds with a bigger focus on achieving climate change targets.

For example, we recently helped a major airport to secure funding from the UK government, enabling it to implement measures that could significantly reduce noise impacts on local communities. Grant funding has also supported airlines in recent years, such as airBaltic and its E-GEN project, which has enabled >500 high precision approaches across Europe on its Bombardier Q400 fleet, significantly improving fuel efficiency levels and reducing CO2 emissions. The UK Department of Transport also provided a grant to Velocys in June this year, supporting the development of technologies that can convert organic household waste into renewable jet fuel. British Airways are working with Velocys to develop a plant to harness this technology to power its fleet of aircraft.

Green funding sources.

Some possible sources of funding that could support your next sustainable project are provided at the end of this blog. This list is not exhaustive (eg it does not include private capital sources) but looking at the criteria they seek and the structures they offer may increase your likelihood of success in a wider trawl for funding. It’s clear there are plenty of positive initiatives ensuring that future sustainability remains a priority.

This is a step in the right direction for the industry and will not only help with the implementation of sustainable concepts but also help the industry recover to a state much better than before, reassuring me of good things to come.

But not all pit-stops are a success. Even the best F1 teams occasionally fail when given the opportunity to take an additional pitstop, with drastic consequences on the final result of the race. Their experience shows that a clear plan needs to be in place to help deal with the unexpected, adapt to an amended strategy and secure the future of the aviation sector.

The Innovation Fund – European Commission – Value: ~€10 Billion

Overview

– Support for up to 60% of the additional capital and operational costs linked to innovation

Grants to be disbursed in a flexible manner based on project financing needs

– Up to 40% of the grants to be given based on pre-defined milestones, prior to project commencement

-Open to small-scale projects with total capital costs under €7.5 million which can benefit from simplified application and selection procedures.

Focus

– Focus on innovative technologies and flagship projects that can bring significant emission reductions

– Aims to finance a varied range of projects across multiple sectors

– Will also support cross-cutting projects on innovative low-carbon solutions that lead to emission reductions in multiple sectors

--------------------------------------------------------

European Bank for Reconstruction and Development (EBRD) – Value: ~€1 Billion in the Transport sector

Overview

– Almost half of the EBRD’s annual investment is now in green energy

– The Green Economy Transition (GET) 2021-25 is the Bank’s approach for helping economies build green, low carbon and resilient economies.

– To date, the EBRD has signed €36 billion in green investments and financed over 2,000 green projects, which are expected to reduce 104 million tonnes of carbon emissions yearly.

Focus

– The EBRD’s vision for the transport sector is to enable safe, secure and sustainable transport systems, which balance economic, environmental and social needs

– Since its inception, it has invested over €17Bn in the transport sector

--------------------------------------------------------

Horizon Europe – European Commission – Value: ~€10 Billion

Overview

– Horizon Europe is the follow up to the Horizon 2020 research and innovation investment programme and is expected to run between 2021 and 2027The programme’s vision is to ensure a sustainable, fair and prosperous future for people and the planet based on European values

Focus

– It is expected 35% of the budgetary target will focus on tackling climate change

– Of the five mission areas of the programme, three are focussed on sustainability: Adaptation to climate change including societal transformation, Climate-neutral and smart cities, Healthy oceans, seas, coastal and inland waters

--------------------------------------------------------

Ten Point Plan for a Green Industrial Revolution – UK Government – Value: ~£12 Billion

Overview

– The ambitious ten-point plan of the UK government is an initiative to create and support up to 250,000 British jobs

– It supports a wide range of industries, helping meet the UK’s goal of achieving net zero emission by 2050

Focus

– Point 6 of the plan is named ‘JetZero and greener maritime’ which aims at supporting the developing zero-emission planes and ships.

– A ‘JetZero Council’ has been formed which is a partnership between industry and government to support the aim of achieving zero-emission flight by 2050

--------------------------------------------------------

EUROGIA2020 – European Commission – Value: ~€1 Billion

Overview

– A cluster of the EUREKA programme, EUROGIA2020’s purpose is to support the development of highly innovative technical solutions. EUROGIA2020 promotes cooperation and coordination among European companies to accelerate development of low carbon energy technologies.

Focus

– EUROGIA2020 projects can address the following issues: To meet the world’s growing fossil fuel needs, while minimizing carbon footprint. To develop diverse clean energy sources in addition to fossil fuels. To improve efficiency of energy use in all consumer and industrial applications. To keep Europe’s market against world-wide competition, To build a sustainable and effective energy system through interactions between technology and society

– It’s latest Call (17) is concentrating on Clean energy and decarbonising technologies